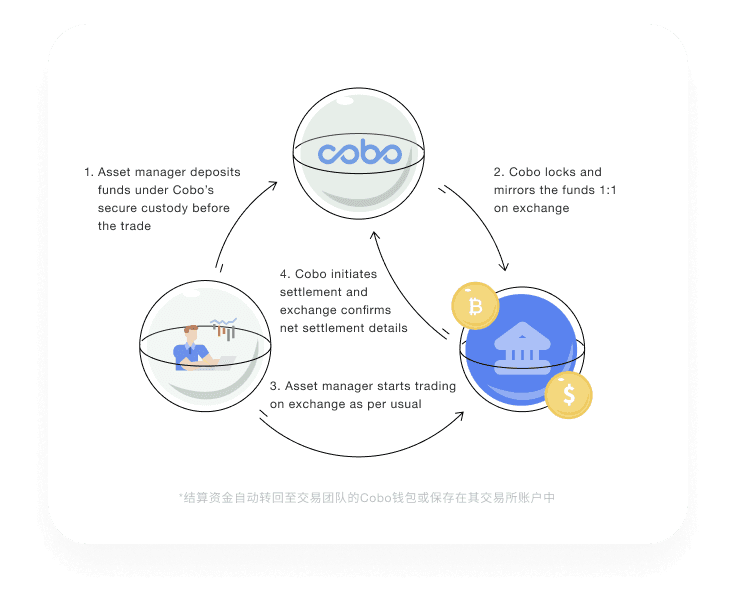

How It Works

- step 1. Asset manager safeguards funds using Cobo’s MPC Co-managed Custody or Full Custody

- step 2. Cobo locks and mirrors the funds 1:1 on exchange

- step 3. Asset manager starts trading on exchange as per usual

- step 4. Cobo initiates settlement and exchange confirms net settlement details

Key Benefits

For Asset Managers: Trade on exchanges with greater confidence and efficiency

Minimize counterparty risk by removing the need to pre-fund on exchanges before trading

Maximize capital efficiency by deploying funds without the delays and risks of on-chain transfers

For Exchanges: Increase trading activity while mitigating counterparty risk

Attract more traders, bigger volumes without pre-funding requirements

Ensure traders can meet obligations before executing trades

Add another layer of security and meet regulatory requirements

Loop Alliance Members

Getting Started

For Asset Managers

- 1. Open an account under Cobo’s Full Custody solution or Co-managed MPC Custody solution

- 2. Start trading on supported exchanges

For Exchanges

- 1. Complete easy integration with Cobo (being a Cobo client is not a prerequisite)

- 2. Start using SuperLoop